One of the main benefits of an FHA loan is its lower interest rate. Although fixed-rate loans are also available, the interest rate on an FHA loan is lower than on other loans. However, this benefit comes with certain trade-offs. Here are some of them:

Low down payment

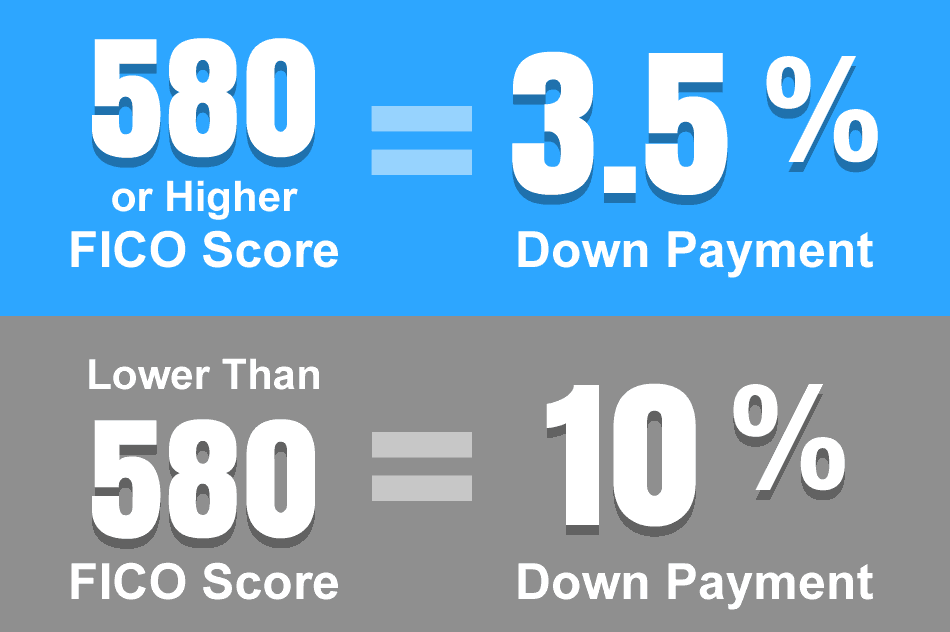

One of the most attractive features of an FHA loan is its low down payment. A typical FHA loan requires only 3.5% down. You can also use gift funds for the down payment. Your lender or seller can also pay closing costs, which will help you minimize out-of-pocket expenses.

Because of its low down payment requirements, an FHA loans in Bexar county can be a great option for people with a low credit score. Depending on your credit history, you may need as little as $4,375 to buy a $125,000 home. Money Management International, a nonprofit debt counselling organization, recommends that consumers with a low credit score look into FHA loans. A low credit score may even qualify you for a lower interest rate than you would with a conventional mortgage.

Unavoidable trade-offs

There are several trade-offs associated with FHA loans. While they are more affordable for some borrowers, they also have higher interest rates than conventional loans. Depending on your credit score and down payment, an FHA loan may be your best option. However, you may be better off with a conventional loan if you are looking to buy a home quickly and don’t have the money for a large down payment. First, you have to qualify for an FHA loan. The requirements for these loans are more stringent than those for conventional loans. For instance, if you have a low credit score and can afford a 10% down payment, you might qualify for an FHA loan. In addition, an FHA loan may not be available in areas with low supply or high demand. Another major disadvantage is that FHA loans don’t have as many options as conventional loans. You should ask a mortgage broker for advice if you’re considering an FHA loan.

Lower interest rate

When looking for a lower interest rate with an FHA loan, it is a good idea to shop around and apply to several lenders. This will ensure that you get the best possible rate for your circumstances. There are a variety of different factors that determine your interest rate, including the economy and your financial circumstances. One of the most important factors to consider is your debt-to-income ratio. FHA loans allow you to have a balance of up to 50% of your income, whereas conventional loans can only offer a maximum of 43%. If you have a lot of debt, you can still qualify for an FHA loan with a lower interest rate.

Assumability

You may want to consider the assumability of an FHA Loan Florida before you commit to a purchase. Assumability depends on the current interest rate and the down payment required for the home’s new owner. For example, if two homes were of similar condition and price, would the buyer of the first home be able to assume the mortgage on the other? This could save the buyer thousands of dollars in mortgage lender fees.

Before assuming the loan, you must obtain an appraisal and a title search. This will ensure that you are not overpaying for the property. It is also important to check if there are any liens or encumbrances against the property.